Technology has impacted almost every aspect of our lives – from the way we shop and pay for goods and services, to the way we communicate with each other. But the financial world, in particular, is one that has been significantly shaken up – banks and credit unions have and will continue to change how they operate and cardholders will be able to access different services.

Cardholders now expect to bank and pay easily at any time and on any device, with a seamless experience. And long gone are the days when we had to wait an age for services like transferring money to be completed. For financial institutions, the challenge is innovating so they can offer a customer experience that meets expectations – one that’s convenient, personalized and fast.

However, there are some physical elements of the customer journey that have been difficult to translate into an on-demand experience, such as issuing a new or replacement debit or credit card. The idea of having to wait for up to 7-10 days to receive a new card and PIN seems almost prehistoric in today’s constantly connected world – but new instant issuance technology is bringing card delivery into the 21st century.

What is instant issuance?

Instant issuance means just that: your debit or credit card is printed, issued and activated on the spot in the branch and can be used immediately. It can also be used for emergency card replacement, giving existing customers the peace of mind they need to continue with their daily lives, even after their card has been lost or stolen.

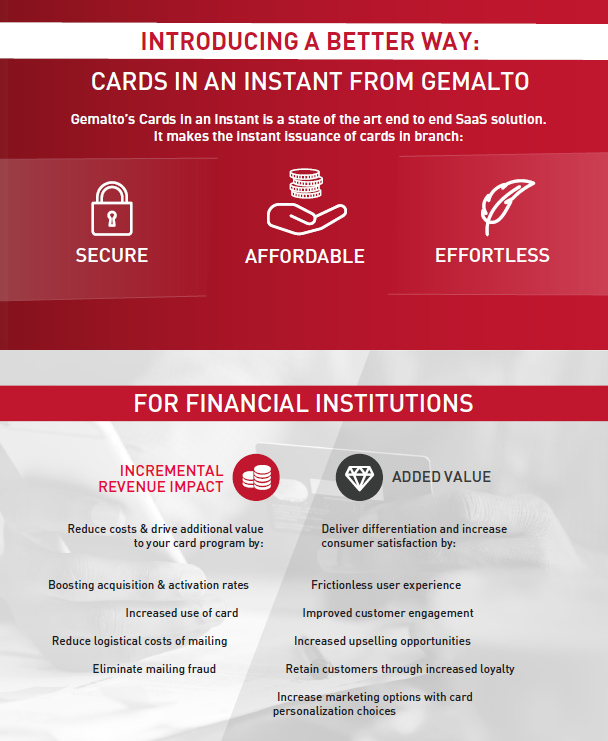

Issuing a card in an instant provides several benefits for financial institutions, the most attractive and important being that it reduces costs and drives additional revenue to the bank’s card program. By providing cardholders with the opportunity to have their card issued within minutes, financial institutions not only increase card activation rates but also boost acquisition. Being able to use the card immediately means more transactions which in turn delivers more revenue. Financial institutions can also then save on postage and mailing costs while reducing the usage of paper.

In addition, with cardholders coming to the branch to have their card issued, banks benefit from increased foot traffic which leads to more opportunities to offer and upsell other services. In turn, they can boost customer loyalty and retain more satisfied cardholders for longer.

But arguably a greater benefit is the improvement in the experience for cardholders. It transforms what was an inconvenient and unavoidable waiting time into instant delivery, which means an instant improvement in customer experience that’s in line with modern expectations.

You can explore more of the benefits of instant issuance in our dedicated infographic – just click the image below.

By transforming the card issuance experience, financial institutions can prove to their cardholders that service innovation is not the sole preserve of modern fintechs, and position themselves well for the future.

But it’s just one way that financial institutions can redefine their products and services for today’s connected world – head to the Gemalto site to find out more.