Regular readers of the blog will know that we often discuss the importance of the customer experience in the banking world.

Technological developments over the past 20 years have transformed how banks interact with their customers – with online and mobile banking now the norm for many. In fact, research from Juniper suggests that more than two billion people will access banking services via smartphones, tablets, PCs and smartwatches this year, a figure which represents almost 40 per cent of the global adult population. And by 2022, more than 70% of the banked population are expected to be using mobile banking services.

The shift to digital has presented banks with many opportunities to innovate, but it also laid the foundations for greater competition (from online-centric start ups and challenger banks) and more demanding customers. As a result, customer loyalty is being tested like never before, with various studies finding that many customers would happily switch to another bank if they felt they could get a better or more modern experience.

One experience that all banking customers will be familiar with is obtaining or defining their PIN code. And this process is another example of how banks can use technology to redefine the service they offer to their customers.

A brief history of the PIN

PIN stands for Personal Identification Number. The first PIN code in a financial services context was created alongside the first ATM, which was launched by Barclays Bank in 1967.

At that point, plastic bank cards didn’t exist, so the machine used cheques which were matched against a PIN code. The inventor, John Shepherd-Barron, had originally intended for a 6-digit code, but his wife intervened and said that she could only recall 4 digits. That’s now commonplace across the world, with the exception of a few countries like Switzerland, who do use a 6-digit code.

For years the PIN code was primarily used to authenticate ATM withdrawals, but the introduction of EMV cards in the mid-2000s gave them another purpose: payment authentication, to provide greater security than signatures.

But although more secure, our use of PIN codes to make purchases can sometimes be undermined but our capacity to remember them! In fact, research from a few years ago found that 18% of consumers use their birthday as their PIN code, 21% have shared their PIN code with friends and 13% keep it written down in their wallet – the perfect gift for any thief who manages to steal it. Other surveys have even suggested that the 10 most common PIN codes (easy to remember but equally easy to crack combinations like ‘1234’ or ‘1111’) make up over 20 percent of all PIN codes used. That might help people to remember them, but it’s also a security risk.

Other elements of the PIN distribution process, such as sending them out via the post, also pose questions about the risk of fraud, and the consumer experience. After all, waiting by your mailbox for 2-3 days to get your PIN seems a little bit backwards in today’s constantly connected world. But the good news for banks is that digital and mobile technology can change many aspects of PIN distribution and definition for the better – and in the process keep their customers satisfied.

Digital PINs for a digital world

Today, digital channels like smartphones, computers or even SMS messages can be used to deliver a PIN code instead of sending them in the post.

The digital PIN service allows customers to get their new PIN instantaneously via their banking app, banking website or via SMS. They can also use those channels to get a reminder of their PIN if they forget it, or to define one.

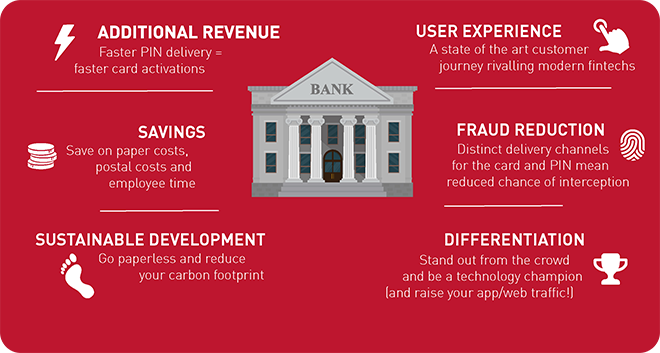

Crucially, this means there’s no need to send them out in the post (removing the associated risks of it being intercepted) or for consumers to write and keep a reminder in their wallet. It can also save banks a significant sum on mailing costs (and therefore help to reduce their carbon footprint) and, because cards can be activated and used immediately, generate additional revenue. And perhaps most importantly, it provides customers with the innovative, forward thinking experience they want to see from their bank.

You can find out more details on Digital PIN in our dedicated video and infographic:

With consumer expectations growing quickly, and technology developing alongside them, banks must continue to innovate if they want to keep their customers loyal and happy. Digital PIN is one such example, but stay tuned for the blog for more thoughts on the topic.